Monday morning news drop

Amateur Investors Rode the Bull Up. Now the Bear Looms. An estimated 20 million people started trading on their own during the pandemic. Some are shifting strategies as stocks tumble, while others are getting out. (New York Times)

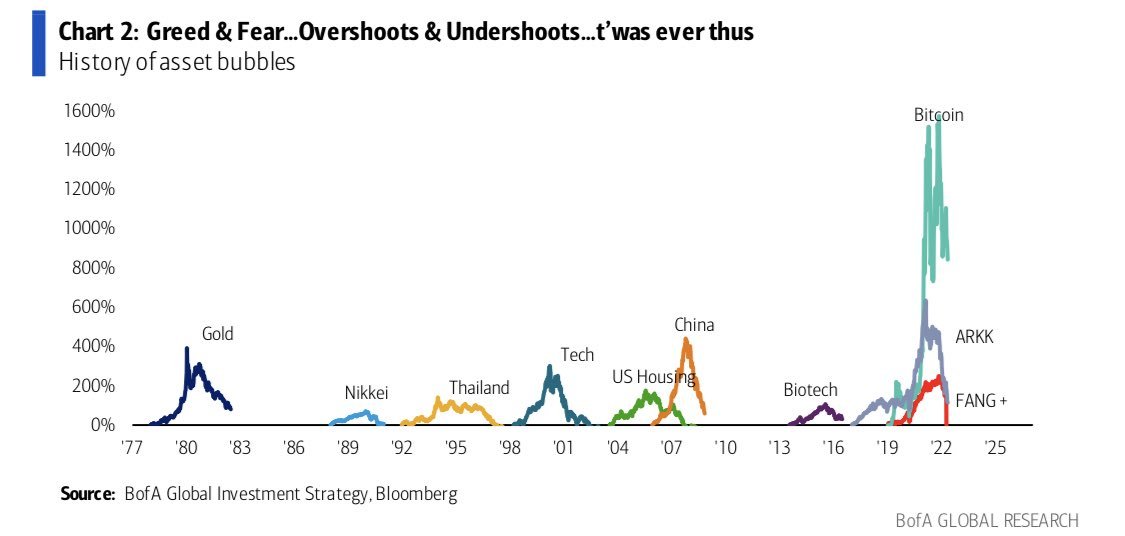

The stock market’s panicking, but you don’t have to: After the stock market plunged at the outset of the Covid-19 pandemic, it’s been on a pretty good run. The S&P 500 climbed by 16% in 2020 and 27% in 2021. The environment made it perhaps a little easy to forget that bull markets don’t last forever, and the waters can get choppy. As the saying goes, markets often take the stairs up and the elevator down, and we’re on the elevator right now. (Vox)

Hedge Trimming: Losing Streaks Coincide Since 1960, there have been 44 individual instances of the S&P 500 index enduring five or more consecutive down weeks. Since 1973, US Treasuries have had 31 such losing streaks lasting at least five weeks. Yet these prolonged sell-offs had never coincided — until the start of May. For the first time in the near 50 years for which we have both data sets, the two sides of a typical 60/40 US portfolio have lost money for five weeks in a row. (Man Institute)

Crypto’s Great Reset: How Digital Asset Investors Will Recover From The Market’s $1 Trillion Meltdown: The bottom fell out from one of crypto’s fastest growing blockchains, LUNA, which promised to succeed where bitcoin failed. Its predictable collapse reverberated across the entire crypto market and is forcing investors to pick up the pieces. (Forbes)

A Crypto Emperor’s Vision: No Pants, His Rules: Sam Bankman-Fried is a studiously disheveled billionaire who made a fortune overseeing trades that are too risky for the U.S. market. Now he wants Washington to follow his lead. (New York Times)

In coal country, a new chance to clean up a toxic legacy: Waste from abandoned and bankrupt mines has contaminated more than 12,000 miles of waterways. Now states are looking at how to extract critical elements from those waters to try to offset the high cost of cleanup. (Washington Post)

The case for revolutionizing child care in America Suskind’s core message: creating a nurturing, interactive environment for kids aged zero to 3 is vital for their development — and many kids are getting left behind during this critical period. Kindergarten — and even preschool — may be too late for interventions to try and close an opportunity gap that begins to open up at birth. She argues we need to start much earlier. (NPR)

How China uses global media to spread its views — and misinformation From covid to the war in Ukraine, China has ramped up its efforts to influence public opinion across the world. (Grid)

The Last of Lehman Brothers: The Long, Slow Death of LEH Is Almost Complete The bank whose collapse marked the beginning of the 2008 financial crisis is only mostly dead. These are the people attending to its last remains ahead of its final court cases. (Bloomberg)

B.C. government put on defensive after 'tone deaf' $789M museum upgrade announcement John Horgan's NDP government has faced blistering criticism for its plans for a new Royal B.C. Museum (CBC)