Wednesday morning news drop

Was That the Bottom? The Russell 2000 Index of small-cap stocks and the Nasdaq 100 were both down nearly 32% and 33%, respectively, from their highs. That’s a pretty decent bear market. Since that day, the S&P 500 is up 13%. The Russell 2000 has shot up 14% while the Nasdaq 100 has bounced 16%. (A Wealth of Common Sense)

If the Economy Is Shaky, Why Are Company Profits Still Strong? Corporate optimism may seem at odds with the Fed’s grim determination to hold back the economy to get inflation down, but earnings tell a story that other data doesn’t. (New York Times)

The pandemic impulse purchases we grew to hate From Pelotons to pets, the Covid buys people wish they’d left on the shelves. (Vox)

The 100 Wealthiest Americans Lost $622 Billion Since November But they’re still a lot richer than they were before the pandemic. (Businessweek)

Corporate Landlords ‘Aggressively’ Evicted Tenants During Pandemic, House Report Says: A new report from a House subcommittee alleges that four companies, including Invitation Homes and Pretium Partners, used harsh tactics to push out thousands of renters. (Bloomberg)

The Water Wars Come to the Suburbs A community near Scottsdale, Arizona, is running out of water. Amid the finger-pointing, the real question is: how many developments will be next? (New Yorker)

The audacious PR plot that seeded doubt about climate change: Thirty years ago, a bold plan was cooked up to spread doubt and persuade the public that climate change was not a problem. The little-known meeting – between some of America’s biggest industrial players and a PR genius – forged a devastatingly successful strategy that endured for years, and the consequences of which are all around us. (BBC)

Why Americans Hate the Media: Why has the media establishment become so unpopular? Perhaps the public has good reason to think that the media’s self-aggrandizement gets in the way of solving the country’s real problems (The Atlantic)

These Vaccines Will Take Aim at Covid—and Its Entire SARS Lineage Scientists are developing vaccines to target the virus family that spawned Covid-19. Their efforts could thwart future variants, or even new related viruses. (Wired)

How colours affect the way you think Our world is awash with a rainbow of colours, but certain shades can have a surprising impact on our ability to concentrate, our mood and even the flavours we experience. (BBC)

How a near-death experience could change the way you live Near-death experiences can occur when someone faces a life-threatening situation such as cardiac arrest or is under deep anesthesia. Some people have reported the feeling of leaving their body and observing their surroundings. For Schiefer, his journey started with what looked like an airplane fuselage. (NPR)

Elon Musk’s Antics Turn Owners and Would-Be Buyers Against Tesla The lightning-rod CEO’s public persona — once a big asset — is increasingly a liability in the EV race. (Bloomberg)

Why So Many Supercars Have Montana License Plates A legal loophole lets owners of expensive cars avoid taxes and emissions standards in other states. Tightening rules could send the practice into overdrive. (Bloomberg)

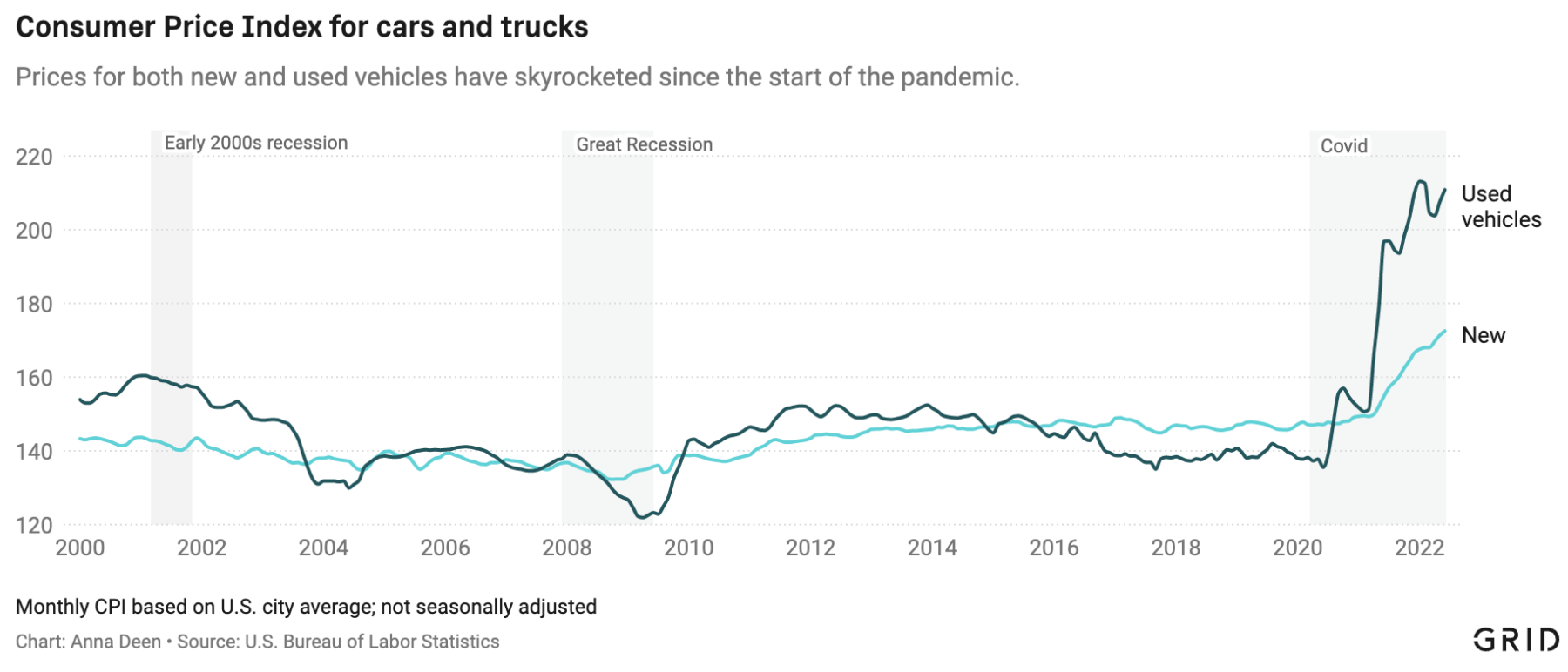

Why are cars so expensive now? A look at the reasons behind the skyrocketing prices and ballooning auto loans. Grid found a net increase of nearly $13,000 in the cost of a new vehicle. Where does that extra cost come from? (Grid)