Thursday morning news drop

Toronto, the Quietly Booming Tech Town For all the excitement around places like Austin and Miami, the biggest tech expansion has been in Canada’s largest city. (New York Times)

The Canadian oil and gas companies that want to put the brakes on climate financial transparency Without more transparency, regulators warn Canada's economy will balloon into a 'climate bubble' that may suddenly burst, causing severe economic disruptions — not dissimilar to recent Russian divestment. But companies such as Suncor and TC Energy want to delay some new mandatory reporting rules, according to an investigation by (The Narwhal)

When the Optimists are Too Pessimistic This is why even the optimists can be too pessimistic. Because we are using linear thinking to imagine a geometric future. It just doesn’t work. (Of Dollars And Data)

Bored Ape’s New ApeCoin Puts NFTs’ Power Problem on Display The story of ApeCoin’s launch also highlights a trouble spot at the cutting edge of crypto, where venture capital firms like Andreessen Horowitz often end up among the biggest beneficiaries (Bloomberg)

He Chased Silicon Valley Dreams Amid the Cannabis Boom. But Did His Ambition Lead to His Murder? Tushar Atre aimed his money and his talents at revolutionizing cannabis extraction. Two years in, he was dead--leaving behind a cloud of questions about the true nature of America's newest gold rush. (Inc.)

How ‘shock therapy’ created Russian oligarchs and paved the path for Putin. It’s a symbiotic relationship in which the oligarchs’ economic power buttresses the political power of the Russian president, and the president’s power buttresses the economic power of the oligarchs — like a medieval king getting tribute from his aristocracy in exchange for his protection. It’s an arrangement that the West is now fighting to disrupt. (NPR)

How the next pandemic surge will be different: The same: The brutal math of exponential growth. Different: Our pandemic fatigue is worse than ever. (Vox)

Covid’s Fifth Wave Shows Us How to Live With the Virus: Not all countries are impacted equally by the BA.2 subvariant. That tells us a lot about what works and what doesn’t. (Bloomberg)

This Kyrie situation is starting to feel like the Mayor of New York is trying to beat him in a game of one-on-one For every game missed it has cost Kyrie $380,000 and Mayor Adams has lifted many COVID restrictions, but not enough for Kyrie to play at Barclays. (Deadspin)

Stablecoins: Growth Potential and Impact on Banking Stablecoins have experienced tremendous growth in the past year, serving as a possible breakthrough innovation in the future of payments. In this paper, we discuss the current use cases and growth opportunities of stablecoins, and we analyze the potential for stablecoins to broadly impact the banking system. The impact of stablecoin adoption on traditional banking and credit provision can vary depending on the sources of inflow and the composition of stablecoin reserves. Among the various scenarios, a two-tiered banking system can both support stablecoin issuance and maintain traditional forms of credit creation. In contrast, a narrow bank approach for digital currencies can lead to disintermediation of traditional banking, but may provide the most stable peg to fiat currencies. Additionally, dollar-pegged stablecoins backed by adequately safe and liquid collateral can potentially serve as a digital safe haven currency during periods of crypto market distress (Federal Reserve)

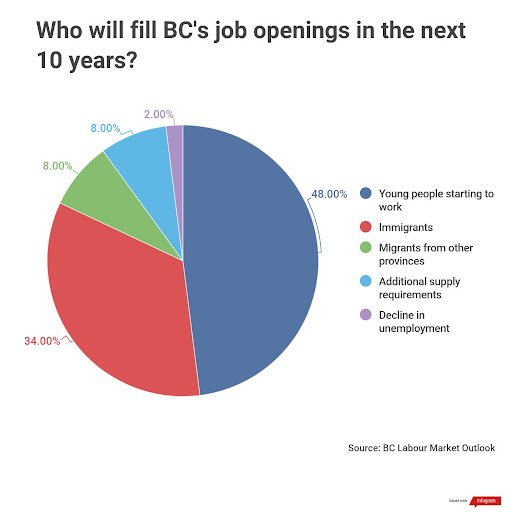

What does Victoria's labour shortage look like? Research predicts BC will have enough workers in the next 10 years—but tell that to businesses desperate for workers. We look at the data. (Capital Daily)