Wednesday news drop

It’s time for two sets of golf rules When was the last time you played golf with a pal who hit the ball so absurdly far that he or she brought the golf course you were tackling to its knees? Simultaneously, consider this: How often does that happen on the PGA Tour? (Toronto Star)

Everybody Hates Millennials: Gen Z and the TikTok Generation Wars The video-based platform may not have created generational animosity, but it’s happy to fan the flames (Walrus)

What If We Never Reach Herd Immunity? Hitting the threshold might actually be impossible. But vaccines can still help end the pandemic. (Atlantic)

Critics Skeptical as Alberta Reverses Course on Open-pit Coal Mines Five days after Kenney defended the province’s mining push, the government says it was all a big mistake. (Tyee)

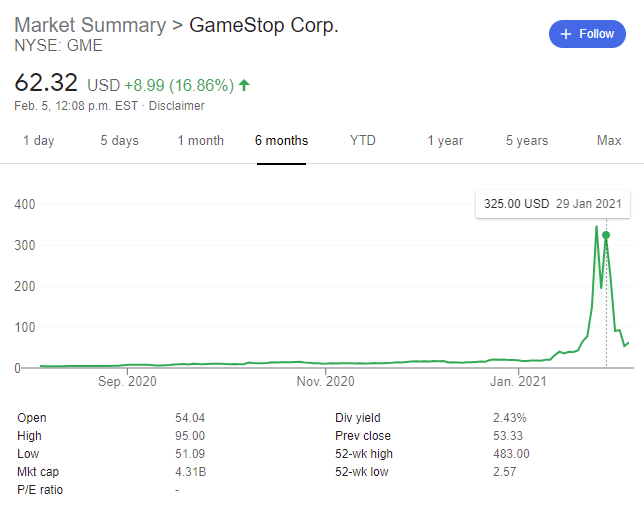

Wall Street’s Most Reviled Investors Worry About Their Fate Short sellers — self-described financial detectives who make money when companies fail — were already worried about their success and safety. Then GameStop happened. (New York Times)

GM's electric vehicle plan could shake up the energy sector — but how soon? 'The future of transportation, starting now, is electric,' says environmentalist working with automaker (CBC)

Norway’s Electric Car Triumph Started With an ’80s Pop Star How a rule-breaking joyride by an MTV icon helped make Norway the world’s EV capital. (Reasons To Be Cheerful)

Is the Bank of Canada’s new boss living up to his climate change credentials? When Tiff Macklem took over as Bank of Canada governor in June he brought the requisite credentials in government and academia, including a past stint as deputy governor of the central bank. But more important to some are his ‘green’ credentials, particularly his chairing of the federal Expert Panel on Sustainable Finance, which in 2019 recommended Canadian financial institutions revamp their business practices to address the challenges of climate change. (Globe and Mail)

Americans take to ‘buy now, pay later’ shopping during pandemic, but can they afford it? It is unclear how buy now, pay later fits into U.S. regulations – the companies that offer these services do not have bank charters, some do not charge interest and laws vary by state. Some experts expect the sector to come under more scrutiny during the new administration. (Reuters)