Tuesday morning news drop

TikTok Was Designed for War: As Russia’s invasion of Ukraine plays out online, the platform’s design and algorithm prove ideal for the messiness of war—but a nightmare for the truth. (Wired)

How War in Ukraine Drives Up Inflation at U.S. Farms, Supermarkets, Retailers The global supply chain is slow, but the economic fallout from the invasion of Ukraine is swiftly raising prices for producers and consumers world-wide. (Wall Street Journal)

Short Sellers Clean Up on Russian Stocks Short sellers have made about $1 billion from stocks like Sberbank and Gazprom — but they may have a hard time realizing those gains. (Institutional Investor)

Russia’s Invasion of Ukraine Puts Cryptocurrencies at the Heart of War While tech leaders push to isolate Russia, the crypto world is clearly struggling to reckon its role in Putin’s war. (Vanity Fair)

Big Investors Are Finally Serious About Crypto. But Experienced Talent Is Still Scarce. “Even if firms aren’t on board with the digital assets movement, they have no choice but to become educated because their clients are constantly asking them about it,” said recruiter Steven Clark. (Institutional Investor)

This Is Peak Subscription Forking over another $5 a month is getting pretty old. (The Atlantic)

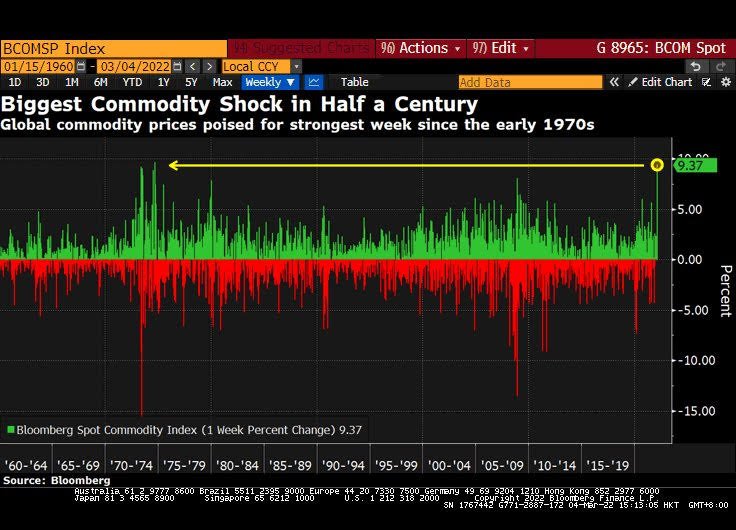

The Boom-Bust Cycle in Commodities Since the inception of the Bloomberg Commodities Index in 1991, it’s up a total of 24%. If you squint hard enough, you can see an annual return of just 0.7%. That’s not only worse than the 2.5% inflation rate in that time; it’s a lower return than you would have earned parking your money in cash. (Wealth of Common Sense)