Monday morning news drop

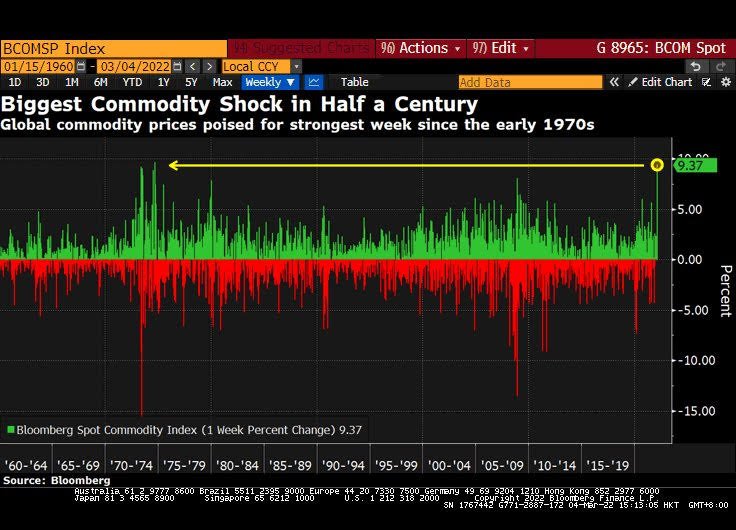

Global Sanctions Dashboard: Special Russia Edition The West has imposed the harshest package of sanctions yet on Russia with the explicit goal of crippling its economy and financial system. The most impactful and surprising development was the sanctioning of the Central Bank of Russia (CBR) by Western allies. Cutting Russia off SWIFT won’t be as impactful as most suggest. Sanctions have crippled Russian major banks’ operations and sent the broader economy into freefall. Neither cryptocurrencies nor a digital ruble can sanction-proof the Russian economy. March is likely to see more sanctions from the United States and its allies, but it remains to be seen whether sanctions can affect the situation on the ground in Ukraine in any substantial way. (Atlantic Council)

The U.S. has unleashed weapons of financial destruction, and economists are watching for long-term fallout They ask: Will weaponizing finance return to haunt U.S. by undermining the dollar's role as world currency (CBC)

A Guide To All The Outrageous Mansions And Estates Owned By Sanctioned Russian Billionaires Forbes uncovered at least 62 properties—worth a collective $2.5 billion—held by 13 targeted Russian oligarchs, ranging from a posh Manhattan townhouse to a grand Italian villa. All are at risk of seizure. (Forbes)

The Ten Hardest Truths About the War in Europe The author of a bestseller on Russia, Ukraine, and links between the Russia-Ukraine conflict and U.S. politics reveals 10 terrifying things about the worst military crisis in Europe since 1945. (Proof)

A Two-Year, 50-Million-Person Experiment in Changing How We Work The office was never one size fits all. It was one size fits some, with the expectation that everybody else would squeeze in. (New York Times)

Will Inflation Stay High for Decades? One Influential Economist Says Yes Charles Goodhart sees an era of inexpensive labor giving way to years of worker shortages—and higher prices. Central bankers around the world are listening. (Wall Street Journal)

Vinyl Sales Soar — and Even CDs Rebound — as U.S. Recorded Music Industry Posts $15 Billion Year-End Revenue But while the $15 billion number is itself a record, when adjusted for inflation, it’s actually ~40% lower than the previous record of $14.6 billion in 1999. (Variety)

Peloton Got Trapped in Its Trillion-Dollar Fantasy: Fueled by manic demand during the early days of Covid, the company spent the next two years chasing a dream of fitness dominance. (Businessweek)

We have the best view yet of Covid-19’s origins. What should we do about it? The latest research points to a spillover from animals at the Huanan Seafood Wholesale Market in Wuhan. The world could take steps to prevent this from happening again. (Vox)

Cryptocurrencies: The Power of Memes The idea that cryptocurrencies will disrupt traditional finance is a meme, not a certainty. Cryptocurrencies are innovative, but to be disruptive they will need to overcome several difficult hurdles. Rather than overcome these hurdles, cryptocurrency has morphed into a permanently speculative investment vehicle, for which disruption lives forever in the future. (Research Affiliates)